Ethereum has completed “The Merge”! Yes, it has happened. The world’s second-largest cryptocurrency has just undergone a significant upgrade, switching from proof-of-work to proof-of-stake. The network successfully transitioned to a proof-of-stake blockchain on 15th September 2022, which marks a pivotal day in the history of Ethereum. The PoW mainnet of Ethereum has now been combined with the PoS Beacon Chain, and there is no turning back. This enormous upgrade has taken years to complete and is expected to lower energy use by 99.95%. Miners are no longer in charge of confirming and adding transactions to the blockchain. Now the question is, what makes the Ethereum merge unique? What impact does a PoS Ethereum have on you? Let’s take a look!

Background of Ethereum

Ethereum has its own cryptocurrency, ether (ETH). It is entirely digital, and you can instantly send it to anybody anywhere around the globe. The supply of ETH is not controlled by any government or corporation; it is entirely decentralized and transparent. Only miners and stakers who keep the network running may produce new currencies (also known as tokens). Every activity on the Ethereum network necessitates the use of processing resources. This payment is made in the form of ether. This implies that using the network requires at least a tiny quantity of ETH.

There are various cryptocurrencies and tokens on Ethereum, however certain things can only be done by ETH.

- Ethereum is powered and secured by ETH.

- The Ethereum financial system is supported by ETH.

- Uses for ETH grow every day.

- ETH may be used as collateral for cryptocurrency loans or as a payment method.

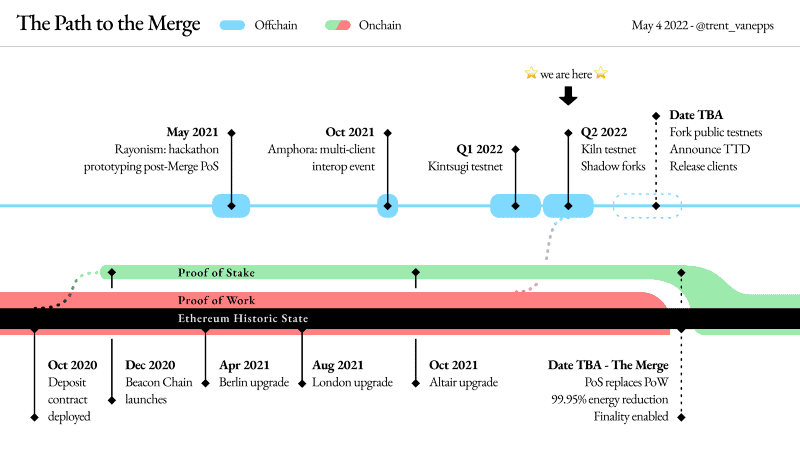

After the Beacon Chain successfully performed it in December 2020, Ethereum researchers and developers decided to divide the transfer into two parts. Right now, there are two independent blockchains for Ethereum operating in isolation. These are the current proof-of-work (POW) Ethereum chain and a separate proof-of-stake Beacon Chain.

The Ethereum network is safeguarded by miners under the PoW paradigm, who must purchase and maintain mining gear. In return for block issuance and a part of transaction fees, miners use a lot Bitcoin power.

What is Beacon Chain?

Beacon is a blockchain that controls staking and the register of validators in a Proof-of-Stake cryptocurrency. The Beacon Chain is at the heart of Ethereum 2.0, storing and managing the registration of validators as well as coordinating the shard chains. The Beacon Chain is a brand-new blockchain that uses proof-of-stake. It may be defined poetically as the spine that supports the whole new Ethereum 2.0 system, the pulse that keeps the system alive, and the conductor that coordinates all the players.

Another useful metaphor is to see the Beacon Chain as a large lighthouse rising over a sea of transaction data. It is continually scanning, verifying, gathering votes, and distributing rewards to validators who properly testify to blocks, deducting awards for those who are not online, and reducing ETH payouts from bad actors.

There are several aspects to this: managing validators and their stakes; nominating the chosen block proposer for each shard at each step; organizing validators into committees to vote on the proposed blocks; applying the consensus rules; rewarding and penalizing validators, and serving as an anchor point for shards to register their states to facilitate cross-shard transactions. The crucial thing to remember is that the Beacon chain cannot execute smart contracts; it will be handled by the shard chains. The Beacon Chain is responsible for producing new blocks, ensuring that those new blocks are legitimate, and compensating validators with ETH for keeping the network safe.

The next step of the Ethereum merge is the establishment of shard chains, which will enhance Ethereum’s data capacity, making the network quicker and more scalable. Ethereum 2.0 will distribute network load among 64 distinct shards, with a single Beacon Chain governing them all.

What Happened During the Ethereum Merge?

Proof-of-stake has long been on Ethereum’s agenda, as it tackles some of the shortcomings of proof-of-work blockchains, such as accessibility, centralization, and scalability. The upgrade created a distinct parallel PoS chain, which could be tested in production without affecting the current PoW network. It also increased the amount of ETH staked so that it was substantial enough to safeguard the network before the “Merge.” The second phase occurred on 15th September 2022, when the Beacon chain’s consensus layer was joined with the Ethereum PoW chain, and the move seemed to be a success. PoW Ethereum transitioned to PoS Ethereum when the Total Terminal Difficulty reached a count of 58,750,000,000,000,000,000,000.

However, ETH’s price remained constant after The Merge was finished, indicating that it had already been priced in. (ETH-USD) is currently trading at $1,600 at the time of writing.

The network is now protected under the PoS model by validators, which makes Ethereum more energy efficient (think laptops and desktops instead of powerful computer GPUs). It also improves Ethereum’s security and provides the framework for future scalability and sharding (which are additional chains used to circulate the network’s transactional load).

Success = Ethereum Merge

Ethereum merged when half the globe was sleeping. The merging went smoothly: just 4% of validators were lost at first, and all “worst case situations” involving billions of ETH were averted.

Proof of Stake vs. Proof of Work

The Proof-of-Work model has devolved into an unjust system in which common participants have no opportunity of receiving mining rewards. However, this is not the case with proof-of-stake, where everyone has an equal potential to become a forger and earn incentives.

Ethereum developers and communities have consistently advocated for a decentralised and transparent environment. Given how prospective hackers exploit the proof-of-work approach, it is easy to see why Ethereum and other crypto projects prefer the proof-of-stake method.

Here are some key comparisons between PoS and PoW to give you a better idea of each.

| Proof of Stake | Proof of Work | |

| 1. | It is a blockchain consensus mechanism that, in addition to Proof-of-Work ensures the integrity of the blockchain. | It is a blockchain consensus mechanism that involves the solution of computationally hard puzzles to validate transactions and produce new blocks. |

| 2. | Does not require advanced computation power. | Requires advanced computation power. |

| 3. | Miners receive a block reward but collect network fees as the reward. | Only the first miner to solve each block calculation is given the reward. |

| 4. | Requires less power. | Power consumption is high. |

| 5. | Not Expensive. | Expensive. |

| 6. | Block creator location is internal. | Block creator location is external. |

| 7. | It has a fault tolerance of only 33%. | It has a fault tolerance of 50%. |

| 8. | In order to add a malicious block, you need to own 51% of all the crypto on the network. | In order to add a malicious block, you need to own a computer 51% powerful than the network. |

| 9. | The community is more decentralized. | The community is more centralized. |

| 10. | Dash, EoS etc use PoS. | Bitcoin and Ethereum 1.0 use PoW. |

How is EIP-1559 a Critical Step in the Proof-of-Stake Transition?

Transaction fees in Ethereum are handed on to miners who include these transactions in network blocks. As a consequence, consumers are often paying $100 or more per transaction through a “bidding” mechanism, particularly when the network is crowded.

That bidding technique is now automated thanks to EIP-1559, which is part of the London hard fork update, making transaction costs more predictable and reliable. When the move to PoS happens, the fee burning will continue. As a consequence, Ethereum will be deflationary while also being significantly more energy-efficient, as Ethereum bulls often emphasize. Although EIP-1559 is the most significant update to Ethereum since its foundation, developers will surpass it now that ETH 2.0 is live.

Ethereum Merge: What Happens Next?

Nothing will change for normal ETH holders. The merger does not result in speedier transaction times, nor does it result in cheaper gas prices. Instead, the Ethereum community is now looking forward to the future, when the network will undergo even more changes. But, for the time being, environmental ETH detractors may relax: according to some estimations, Ethereum’s transition to proof-of-work is akin to Finland shutting down its whole electricity system. Some important facts about the speculations regarding the merge as listed below.

Ethereum Now Consumes 99.95% LESS Energy

The merger’s most immediate consequence is a decrease in Ethereum’s energy consumption. Proof-of-work requires a lot of energy to operate with miners, but proof-of-stake Ethereum will need 99.95% less energy. Ethereum’s issuance rate will decrease by 90%.

Gas Prices and Transaction Times will Remain Unchanged

The merger has nothing to do with speeding up transactions or cutting gas prices. Both of these are in the Ethereum roadmap, but they are still a long way off!

Ethereum Stakers Cannot Immediately Unstake

- Stakers will be unable to withdraw their staked ETH for 6 to 12 months after the merger, thus there is no need to be concerned about ETH flooding the markets right now!

- Staked ETH will be made accessible after the upcoming Shanghai upgrade, but procedures are in place to prevent the market from being oversaturated with ETH.

The Ethereum merge was divided in phases, which are:

Phase 0: The Beacon Chain will now be responsible for monitoring validators and supplying the PoS consensus mechanism, as well as dispensing penalties and rewards, at the start of Phase 0. This was supposed to take place in January 2020.

Phase 1: Introduction of sharding, which divides the Ethereum network into 64 distinct chains. Although it would seem natural to assume that this would expand capacity by 64, it is possible that ETH 2.0 can handle hundreds of times more transactions per second than its predecessor. This section of the plan was scheduled for 2021 but still not live.

Phase 2: The introduction of ETH transfers and withdrawals, as well as smart contract capability, ultimately leading to the demise of the Ethereum 1.0 network. It is intended that this would be operational by 2022.

Next Milestones Post the Ethereum Merge

There will be many more enhancements in the future to assist Ethereum increase scale and decentralisation. The following are the upcoming milestones:

- The Surge: sharding to improve scalability, especially for rollups (TBD)

- The Verge: stateless clients that make running Ethereum nodes simpler (TBD)

- The Purge: removing technological debt and erasing previous data (TBD)

- The Splurge: more features and delights (TBD)

What Changes for You?

If you are a validator, you must update. Existing ETH miners have limited choices, such as switching to other GPU-mined proof-of-work currencies like Ethereum Classic and Ravencoin. Miners might also use their machines for other GPU-intensive tasks like machine learning or rendering farms. For the vast majority of you, not much. If you have any Ether in your exchange account, it will remain there even after the merge. And if the 7% price increase is any indication, it may be a good time to HODL.

If you are a developer, expect that the Ethereum merge will alter block structure, block timing, and opcode modifications, disrupt on-chain randomization sources, and alter the idea of safe head and finished blocks.

Questions that Need Answers ASAP

With so many narratives going around in the community regarding the Ethereum merge, debugging certain questions becomes important. You’re sure to find your queries about the Merge answered in this section.

Q: Will the merge lower my Ethereum gas costs?

A: No. The transformation from proof-of-work to proof-of-stake has no effect on the network that would result in cheaper gas prices. Only subsequent advancements, like as the 2023 sharding upgrade, should see Ethereum’s throughput drastically rise when blocks are created in parallel, lowering costs.

Q: Will the merge speed up Ethereum transactions?

A: No. the merge will actually reduce Ethereum transaction times marginally. Ethereum creates a block every 12-14 seconds under proof-of-work (currently averaging at 13.36 seconds). After the merge, a new block will be created every 12 seconds, which is more than 10% quicker than previously. In most circumstances, this means that transactions will be verified 10% quicker.

Q: Will the merge bring Ethereum offline?

A: No. That’s not possible. Many exchanges halted Ethereum network deposits and withdrawals for many hours until the merge took place but they have been resumed now. There was no downtime.

Q: Will Ethereum use shard chains after The Merge?

A: No. Shard chains are not likely to be used until 2023.

Q: What are Ethereum miners going to do after The Merge?

A: Following the merger, Ethereum miners will no longer be able to assist protect the network and, as a result, will no longer collect block rewards. Some miners may switch to GPU-mined proof-of-work currencies such as Ethereum Classic (ETC) and Ravencoin. They may also use their GPUs for other GPU-intensive tasks, such as machine learning or rendering farms. There is also a potential that a POW Ethereum split may emerge, allowing miners to continue their work.

Q: What exactly is the Goerli testnet?

A: Goerli is one of many Ethereum testnets. Developers use it to bug and stress test their apps before publishing them to the Ethereum mainnet. It was the last testnet to complete the merging and convert to proof-of-stake, preparing for the big event in September.

Q: Will the staking APR rise after The Merge?

A: Ethereum.org predicts that staking returns will rise following The Merge, since transaction fees will be distributed to validators rather than miners. According to the site, the APR for staking on Ethereum will rise to 7% after The Merge. Based on the Beacon Chain’s staking return of 4.3-5.4%, Coinbase estimated early this year that staking yields will climb to more than 9-12% APR.

Q: Can ETH be staked after The Merge is completed?

A: Not right now. Staked ETH will be trapped on the beacon chain for 6-12 months, until the Shanghai upgrade occurs. To withdraw staked ETH, validators must depart the current validator set. The number of validators that may depart each era is limited. Withdrawals will be available after the Shanghai update.

Q: Is The Merge equivalent to ETH 2.0?

A: The consensus layer is now known as ETH 2.0, whereas the execution layer is known as the original POW chain – ETH 1.0. These are referred to collectively as Ethereum.

Q: How much ETH is required to operate a node after The Merge?

A: After the merge, you must still stake at least 32 ETH to activate your own validator. However, with pooled staking (including liquid staking solutions), staking-as-a-service platforms, and centralized exchanges, you will be able to share a validator with other individuals. If you don’t have 32 ETH to stake, you may operate a node that does not propose blocks but still helps the network by listening for new blocks and verifying them.

Ethereum Merge: The Beginning of an End

The Ethereum merge is a huge milestone for the Ethereum ecosystem but the real work starts now. There are still more steps to go. Ethereum still needs to grow, needs to improve privacy, and needs to make things really safe for normal users. The Merge symbolises the gap between early-stage Ethereum and the Ethereum we’ve always desired. Moving to PoS was afflicted by delays and put back many years, akin to replacing a car’s engine while it was going at high speed.

Happy Merge!

The crypto community is celebrating Ethereum’s move from the proof-of-work (PoW) consensus mechanism to the proof-of-stake (PoS) model. The measure is intended to reduce the electricity required to secure Ethereum by around 99.95%, assuaging people concerned about the environmental effect of cryptocurrency (Ethereum currently emits as much carbon as Singapore and its total energy consumption is similar to the Netherlands). ETH (ETH-USD) issuance will also fall (a.k.a. Triple Halving), while industry participants will further decentralize the network by securing Ethereum at home, removing some influence from institutions and skilled miners.