Decentralization is a basic principle of blockchains and cryptocurrencies. The primary goal of the crypto ecosystem is to eliminate entities with significant control over blockchains, which is why cryptos do not face misuse of authority or third-party intrusions. Decentralization is one of the key differences in the Solana vs Ethereum debacle. ETH is a decentralised network that previously used a PoW consensus mechanism but transitioned to a PoS protocol recently. In contrast, Solana is more centralised. This is because a third of Solana’s top validators own more than 35% of the stake. This significant part enables these individuals and entities to impact the value of Solana depending on their market share. Is Solana centralized completely? Let’s find out.

What is Solana?

Solana is a public, open-source blockchain that promises to provide scalability and smart contract capabilities while maintaining decentralisation and security. This is accomplished by a revolutionary timestamp method known as Proof-of-History (PoH). The network may use PoH to arrange and batch transactions before they are processed by a Proof-of-Stake (PoS) method. Sub-second settlement times, minimal transaction costs, and compatibility for all LLVM-compatible smart contract languages, including Rust, C, C++, and, eventually, Move, are all its design goals.

Solana’s History

Solana’s mainnet went live in 2020. Yet, the project has a long history. Prior to launching Solana, the founding team had spent years at Qualcomm developing operating systems for the first smartphones. Anatoly Yakovenko, a co-founder of Solana, has mostly focused on methods for synchronising computers in a network.

Anatoly recognised that synchronising network nodes across decentralised networks was problematic since these networks could not depend on external clocks after shifting his focus to decentralised blockchain networks. Bitcoin and Ethereum have overcome this issue using the Proof-of-Work method, which is dependable but dramatically slows down the network.

Anatoly Yakovenko outlined Proof-of-History, a revolutionary approach for keeping track of time between computers that don’t trust each other, in his whitepaper released in 2017. This method, according to the whitepaper, has the potential to enhance the speed of blockchain networks by a thousand times or more.

Anatoly began developing the Proof-of-History algorithm alongside his former colleagues Greg Fitzgerald and Stephen Akridge, and eventually scaled up the technology to operate on a cloud-based testnet. To prevent conflict with another crypto project, the team first dubbed their project Loom before renaming it Solana. Solana is named after a little beach in California where Anatoly and Steven resided and surfed for three years while working at Qualcomm.

Reasons Why Solana is a Bit Centralized

Solana bills itself as a blockchain that is decentralised, permissionless, safe, and scalable. Yet, in the crypto realm, Solana is often criticised for not being really decentralised. This critique is somewhat fair since Solana has much fewer nodes than Ethereum or Bitcoin. The reason for this is that Solana’s high transaction volume necessitates significant hardware needs for validators. There are few other reasons to support this claim.

Expensive to run a validator

When we talk about Solana vs Ethereum, Solana’s Nakamoto coefficient is pretty high, 19 validators are required to halt the network. 19 may not sound like a huge number, but it’s higher than Ethereum’s Nakamoto coefficient. The Nakamoto Cofficient for PoW Ethereum was 3, and for PoS Ethereum it’s 4 (source: http://etherchain.org/miner.) Network participants that wish to operate validator nodes must purchase custom-built hardware. Nodes should be operated on a computer with at least 256 GB of Memory, a 16- or 32-core CPU, and a commercial high-speed internet connection of at least 1 Gbit/s, preferably up to 40 Gbits/s. As a result, personal PCs and conventional fibre optic internet connections cannot operate Solana validator nodes.

The highest percentage of its validators are concentrated on Hetzner. HTZ has led the charge in validators, with ~40% of validators and 20% of the stake. Other points of concern in terms of the stake are Equinix and AWS. Together, these three have 65% of the stake.

Addtional Read: Ethereum Shanghai Upgrade: All You Need to Know

Token distribution

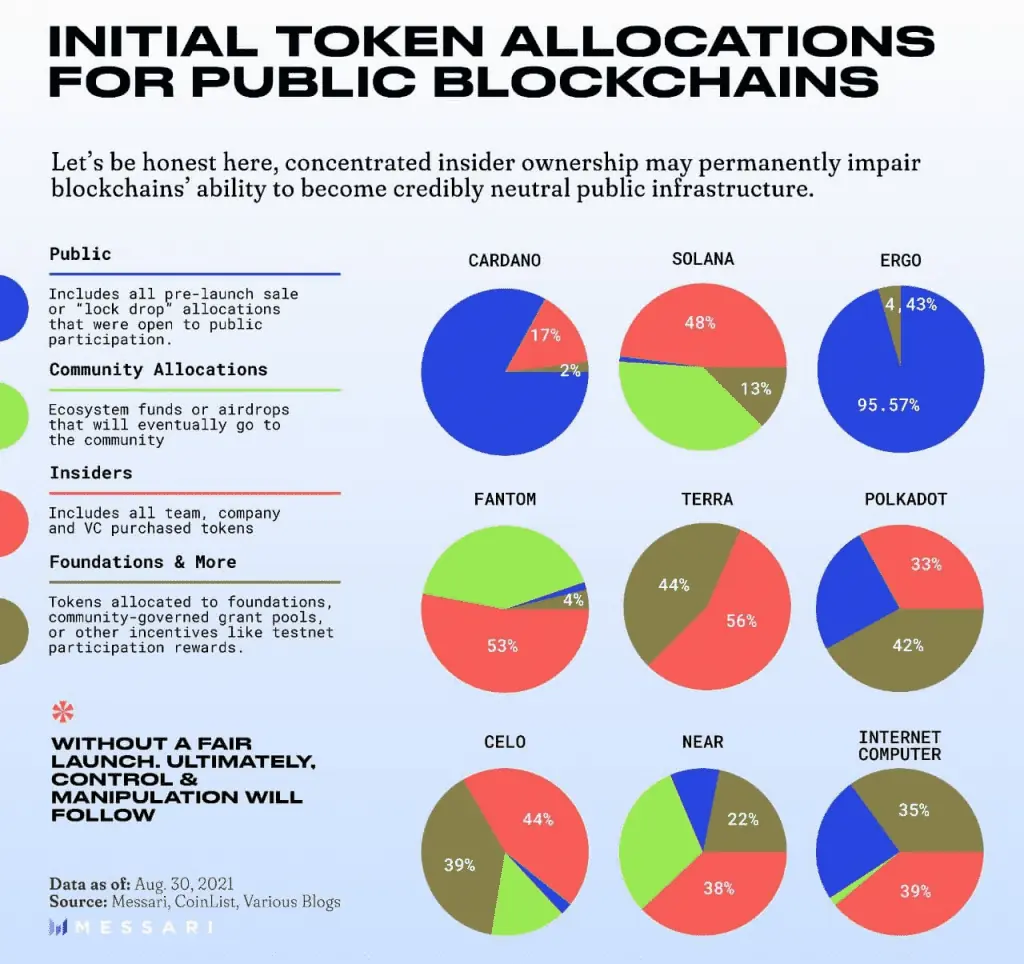

Another way that Solana may be relatively centralized is that the ownership of $SOL seems to be much more highly concentrated than the ownership of ETH. An aspect of SOL ownership being relatively centralized is that today, 40% of SOL (vs. 0% ETH) is considered “non-circulating supply” (source: coingecko.com) in that it’s either locked up in enterprise agreements or held by Solana itself. The Solana Foundation controls what to do with these tokens, giving them a lot of power to influence the ecosystem.

Solana’s initial token allocation was quite centralized too. Half of the tokens are owned by VCs & insiders while a mere 19 nodes control the network. Refer to the image below.

A class-action lawsuit was filed against Solana in a federal court in California in July 2022, alleging that the platform favours insiders at the cost of investors. Solana Labs creates value by issuing unregistered security, the SOL token.

Only one blockchain software client

There’s only one blockchain software client in Solana, i.e. only one program needs to be modified to remove your property rights and Solana is not close to having two production clients.

Other Factors

The network was brought to a halt two years back by a Denial of Service (DOS) attack that swamped it with unauthorised traffic. As the network grew congested, genuine transactions were impossible, and Solana’s 1000+ validators decided to “restart” the network. For over 18 hours, the whole Solana blockchain remained unavailable. Processing and confirmation of new blocks were not feasible when validators crashed to the point that they could not mutually agree on the correct and current status of the network. The community of 1000+ validators was eventually able to reach a reasonably quick resolution and reset the network.

The controlling entities having more than 33% of Solana’s ownership have the ability to suspend the Solana blockchain at any moment. Due to network challenges, this has been required numerous times in 2022. If Google Cloud becomes one of the primary validators, it may get engaged in these matters. If not, its voice carries a lot of weight since it is “THE” Google Cloud.

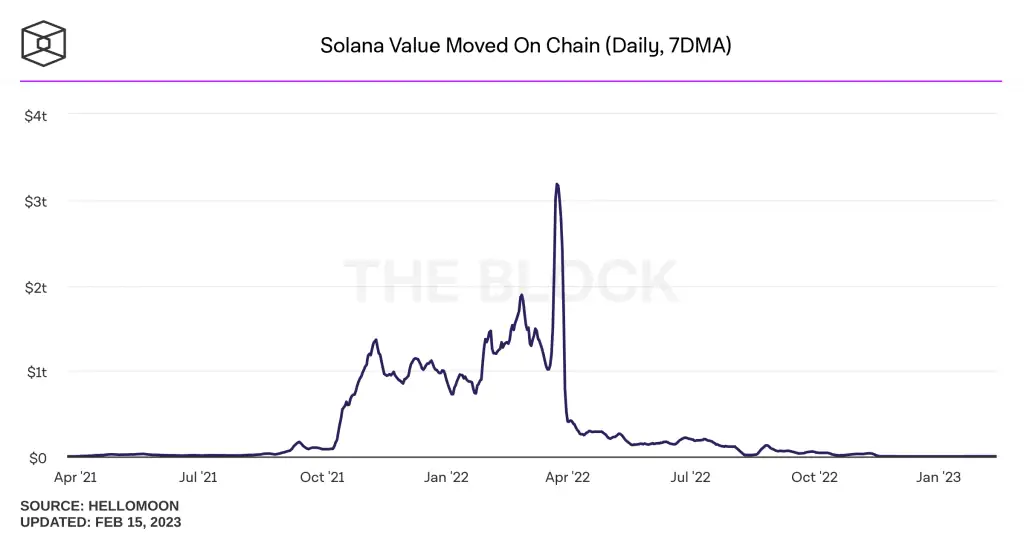

Additionally, Solana went from being a possible “Ethereum killer” to being one of the worst-performing assets in 2022. In the image below, it can be seen that on-chain value movements have dropped significantly since April 2022.

End Word

Centralization is a spectrum, not black and white. Solana is more decentralized in some aspects and more centralized in others. Right now, things are decentralized enough and will become more decentralized over time. Although the blockchain has made tremendous progress in this area, yet, Solana is a 5-year-old project that is still in the works. More work needs to be done to increase the number of transactions that can be completed per second. Also, it must strive to increase the speed with which transactions are confirmed on the network. When it comes to dApp hosting and new NFT collections, Solana is the second most popular network after Ethereum. Therefore, the Solana Foundation’s incentives and rewards will continue to rise, and the community will stake more $SOL tokens.